nebraska tax withholding calculator

Nebraska tax withholding calculator Nebraska Withholding Tax. There are four tax brackets in Nevada and they vary based on income level and filing status.

Details of the personal income tax rates used in the 2022 Nebraska State Calculator are published below the.

. To use our Nebraska Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Ad Download Or Email NE form 20 More Fillable Forms Register and Subscribe Now. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. As an employer in Nebraska you have to pay unemployment insurance to the state. August 5 2021 by Kevin E.

Calculating the withholding at 15 would result in a withholding amount of 788 525 X 015 over 10 times the amount originally determined. Supports hourly salary income and multiple pay frequencies. Click image to enlarge Set up company tax information option.

If youre in the construction industry your rate is 54. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. If it seems like your paychecks are on the small side and you always get a.

Both cardholders will have equal access to and ownership of all funds added to the card account. Highlights include links to FreeFile free tax software and the IRS withholding calculator. Income Tax Rate Indonesia.

Tax Information Sheet Launch Nebraska Income Tax Calculator 1. Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska. Overview of Nebraska Taxes.

Free for personal use. After a few seconds you will be provided with a full breakdown of the tax you are paying. You must pay estimated tax if you dont have your tax withholding taken out by an employer or if you are self employed.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. There is no commitment to pay for Social Security for the earned income above this base limit as well as the price is equivalent for each worker. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022.

Nebraska Withholding Tax Federal. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup screen. March 1 2022.

Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State. Payroll check calculator is updated for payroll year 2022 and new W4. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Restaurants In Matthews Nc That Deliver. Nebraska Income Tax Table Tax Bracket Single. Opry Mills Breakfast Restaurants.

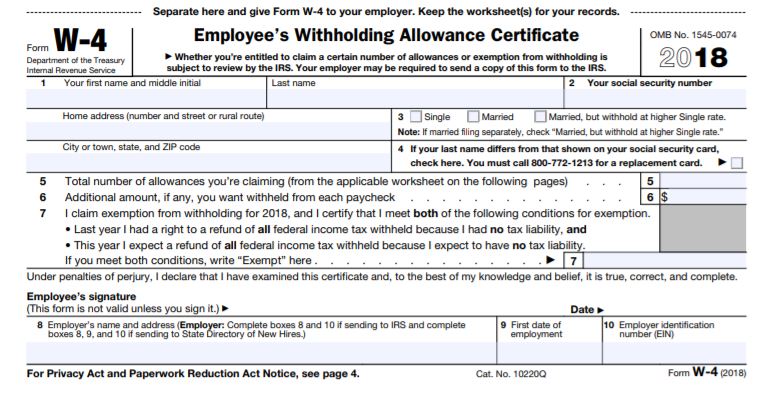

The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska income tax withholding. In 2012 nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Nebraska local sales tax rates Lists towns and local tax rates.

If youre a new employer congratulations on getting started you pay a flat rate of 125. The Social Security tax withholding is rated at 62 by the federal government up to the base of 2021 annual wage at 142800. Income Tax Withholding Reminders for All Nebraska Employers Circular EN.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Nebraska Tax Withholding Calculator.

Soldier For Life Fort Campbell. Nebraska State Tax Forms. Need help calculating paychecks.

Nebraska tax withholding calculator. October 14 2021 Effective. Use tab to go to the next focusable element.

All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022. Internal Revenue Service Get information forms instructions and answers about your federal income taxes. 691 rows In 2012 Nebraska cut income tax rates across the board and.

The best way you can change tax withholding and the size of your paychecks is to update the information in your W-4. 19 in Nebraska and Alabama 21 in Puerto Rico Identity verification is required. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Instead you fill out steps 2 3 and 4. This free easy to use payroll calculator will calculate your take home pay. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022.

Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Please make sure you select the correct Pay Period there. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Essex Ct Pizza Restaurants. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each employee in a calendar year. Nebraska Hourly Paycheck and Payroll Calculator.

Form W-3N Due Date. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the. Nebraska Department of Revenue Contact Information. State copies of 2021 Forms W.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. The 2021 rates range from 0 to 54 on the first 9000 in wages paid to each employee in a calendar year. The Nebraska income tax has four tax brackets with a maximum marginal income tax of 684 as of 2022.

SmartAssets Nebraska paycheck calculator shows your hourly and salary income after federal state and local taxes. Here are some of the changes associated with withholding tax as a whole. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Nebraska.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Reducing the number of withholding allowances to 2 for state purposes only would set the withholding amount at 240 which falls within the nonshaded area of the table. Delivery Spanish Fork Restaurants.

Calculate your state income tax step by step 6. Free federal and nebraska paycheck withholding calculator.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Income Tax Brackets For 2022 Are Set

Accounting For Agriculture Federal Withholding After New Tax Bill Cropwatch University Of Nebraska Lincoln

2020 W 4 Form Example Filled Out

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Income Tax Calculator Estimate Your Refund In Seconds For Free

Income Tax Brackets For 2022 Are Set

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Income Tax Calculator 2021 2022 Estimate Return Refund

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Nebraska Paycheck Calculator Smartasset

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

The Four Rules Personal Budget Budgeting Ways To Save Money

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube