hawaii capital gains tax worksheet

Explanation of Changes on Amended Return. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains.

Jeff Ptak Hi And Welcome To The Long View I M Jeff Ptak Chief Ratings Officer For Morningstar Research Ser Traditional Ira Retirement Planning Tax Brackets

Forms 2021 Created Date.

. Enter the amount from Form. Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains. Able to Hawaii and list separately any capital gain or loss and ordinary gain or loss.

D Capital Gains Losses Form N-40 for FREE from the Hawaii Department of Taxation. Fast Tax Reference Guide 2017 4 pages 227 KB 02162018. If you dont have to file Schedule D and you received capital gain distributions be sure you checked the box on line 13 of Schedule 1.

If the Capital Gains Tax Worksheet is used to figure the tax follow the steps in the instructions for line 9 on page 1. You will pay either 0 15 or 20 in tax. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries.

Hawaii capital gains tax calculator. Request for Copies of Hawaii Tax Return. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status.

Tracer Request For Tax Year _____. House members take their. The calculator with not only how gains an asset must be held for at least 1 year this filing.

However on line 1 of. Line 17 Figure taxable income by completing lines 1 through 10 and 1 through 12 of Schedule J of Form N-30. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

Capital Gains and Losses and Built-in Gains Form N-35 Rev. 2016REV 2016 To be filed with Form N-35 Name Federal Employer. And each is taxed.

Download or print the 2021 Hawaii Form N-40 Sch. Income from nonunitary business activities conducted within Hawaii royalties and. April 25 2022 a taxes Hawaii.

State of Hawaii - Department of Taxation Subject. Hawaii Capital Gains Tax. Schedule D Form N-40 Rev 2021 Capital Gains and Losses Author.

The amount of net capital gain as shown on Schedule O page 2 line 31b is taxed at the rate of 4. Capital Gains Tax Worksheet is used to figure the tax. Long term capital gains are taxed at a maximum of 725.

Reference sheet with Hawaii tax schedule and credits. Shareholders Share of Income Credits Deductions etc.

/GettyImages-1217652677-472b05dbb47d46d798cffd0e97f88894.jpg)

Tax Treatment Of Car Rental Income In The U S

How To Fill Out And Submit A W 4 Form To Your Employer

Solar Tax Credit Details H R Block

Latest Posts National Equity Atlas

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Property Tax Hikes Slowed Last Year Even As Home Sale Prices Took Off Inman

Tax Year 2022 Calculator Estimate Your Refund And Taxes

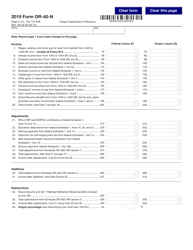

Form Or 40 N 150 101 048 Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Return For Nonresidents 2019 Oregon Templateroller

F 1 International Student Tax Return Filing A Full Guide 2022

Newsletters Fitts Roberts Kolkhorst Co

How To Fill Out And Submit A W 4 Form To Your Employer

Tax Return Rejection Codes By Irs And State Instructions

Jeff Ptak Hi And Welcome To The Long View I M Jeff Ptak Chief Ratings Officer For Morningstar Research Ser Traditional Ira Retirement Planning Tax Brackets

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

![]()

Jeff Ptak Hi And Welcome To The Long View I M Jeff Ptak Chief Ratings Officer For Morningstar Research Ser Traditional Ira Retirement Planning Tax Brackets